Running your own small business is an adventure. But when you’re the boss, you’re also susceptible to all the potential risks involved — and there are a lot.

That’s why risk management is essential to your small business staying afloat and achieving long-term success.

Here are four steps to practice small business risk management the smart way:

1. Identify risks

A good risk management strategy includes doing regular risk assessments.

To perform a small business risk assessment, start by writing down the types of risks your business may face, and how they might arise during normal business activity.

For example, your small business may face internal risks like losing key people, or people becoming injured or sick. You could experience property loss, business interruptions, equipment malfunctions or building problems.

Your business might be impacted by external risks like natural disasters, market changes or infrastructure issues.

Small businesses are sensitive to financial risks, like insufficient cash flow, excessive debt, or losing important clients.

There are strategic risks, which may be risks your small business takes intentionally to grow.

And then, there are reputational risks like getting bad online reviews, which can especially impact small businesses.

2. Categorize your risks

Not all risks are equally likely to happen, and they won’t affect your business in the same way.

Once you have your list, the next step in the risk management process is determining the likelihood that the risks will happen. Consider their possible impacts on your business operations and its future growth.

You’ll want to bring your attention to your high-probability, high-impact risks first.

3. Come up with a risk management plan

Now that you’ve written down and categorized all the risks your business faces, it’s time to come up with your risk management plan.

A good risk management plan determines how you’re going to mitigate your risks — which means reducing their likelihood or the threat they pose to your business.

Risk mitigation strategies for a small business usually fall into the following categories:

- Avoid the risk. This means changing something in your business so the risk no longer exists. For example, to avoid the effects of a hazardous chemical, you could replace it with a less dangerous substitute.

- Control the risk. This doesn’t remove the risk but reduces its potential impact on your business. An example might be finding more clients, so you’re not overly dependent on a single client for your income.

- Accept the risk. Accepting a risk means pre-budgeting for it or making a contingency plan: think about how a supermarket budgets for shoplifting losses into its profit and loss statement.

- Share the risk. There are simple ways to shift some of your risk onto a willing third party. This could mean outsourcing some of your work or getting covered by business insurance.

Since you’ve categorized your risks, you’ll be able to choose the right risk mitigation strategy depending on the level of threat each risk poses.

4. Insure against your risks

Even the most thorough risk assessments aren’t perfect. The reality is there's a lot you just can’t predict.

One of the best ways to guard your livelihood against unforeseen events is to get small business insurance.

As a small business, general liability insurance provides broad protection for some of the most common risks you face. Workers’ comp is a must in many states, if you have employees.

For many small businesses, coverage like professional liability insurance, commercial property insurance, commercial auto insurance and even tools and equipment insurance can make sure you’re prepared for all kinds of rainy days.

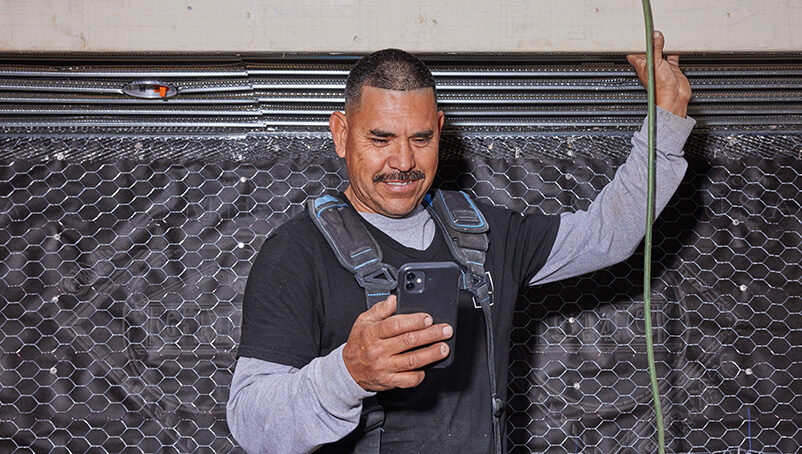

Not sure what kind of insurance coverage you’ll need or how much you’ll need? Not to worry — online insurance companies such as NEXT make it simple by walking you through the process step-by-step. You answer a few simple questions about your business and can see recommended insurance policies.

NEXT makes small business risk management simple

At NEXT, we’re committed to small business owners, which is why we offer customized insurance that fits your needs.

Everything is online and streamlined. You can compare options, get a quote, and buy coverage, all in about 10 minutes. You’ll have access to a live certificate of insurance right away.

Start an instant quote today.