The lowest premium for NEXT commercial property insurance can start at just $168 per year (or $14 per month).†

What you’ll pay for your small business will depend on your industry, location and work experience, as well as your insurance claims history and the policy limits you choose.

To get specific about your cost for a commercial property insurance policy, use our premium calculator or get a free quote.

Examples of monthly median cost for commercial property insurance by profession

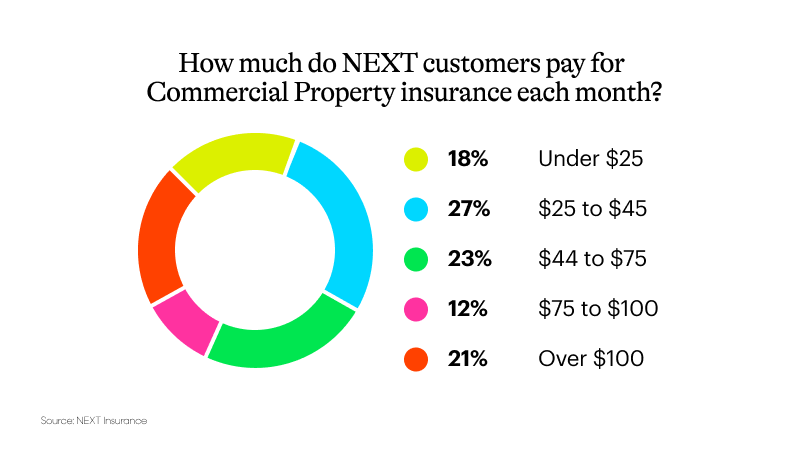

Source: NEXT Insurance

How insurance companies calculate Commercial Property Insurance cost

Insurance companies calculate your premium by considering several higher risk factors, including:

1. Your type of business or industry

A florist likely may pay less than a restaurant because the equipment they use to do their job is less likely to get damaged or cause accidents.

The cost for retail stores, which have inventory, equipment and physical commercial buildings, may be higher than other professions because they face more daily risk.

In general, jobs that rely on business property and would suffer serious losses if there were property damage or destruction often have higher insurance costs.

2. Your business location

If your building, warehouse, office, manufacturing facility or storefront is in downtown Los Angeles you’re probably going to pay more for commercial property coverage than if you’re located in rural Pennsylvania.

This is partly due to the increased threat of natural disasters like hurricanes along a coastal area.

It’s also due in part to more populated areas that have higher property value and more crime.

3. Your work experience

The length of time you’ve operated a business in your industry can impact your insurance rates.

For example, if you’ve been a nail technician for 10 years, you’ll likely pay less than a barber in business for two years because you have a proven history of success in your field.

4. Your claims history

Your record of losses and claims can also have an impact on your insurance premium.

For example, if you own a bakery that caught fire and had to have major repairs, you may see a higher premium when it’s time for your policy renewal.

5. How you set your insurance coverage limits

You can elect to have higher insurance coverage limits on your policy to give you more help and protection over more covered incidents. While more types of coverage can be a good thing, higher coverage limits can increase the cost of your policy.

Note: These are only a few common factors that affect your cost. Insurance companies take many other external factors into account such as economic conditions and market trends.

4 tips to help lower the cost of Commercial Property Insurance

You can take control of several actions that may help lower your insurance cost, including:

1. Reduce your risk

Keeping your commercial business property safe and secure can help limit the likelihood of accident, injury and filing an insurance claim. And if you take action to reduce harm, particularly if your small business relies on inventory and equipment to operate, you’re more likely to keep your premium low.

Consider enhanced safety practices such as:

- Installing a fire-retardant sprinkler system.

- Installing more fire extinguishers and smoke detectors.

- Upgrading your security system.

- Minimizing tripping and falling hazards in the workplace.

- Conducting regular safety checks to keep your job site safe.

2. Learn from previously filed claims

Analyze your previous insurance claims and figure out what you could have done to avoid those events.

For example, if you filed a claim because of stolen merchandise, you could train your employees to recognize and react to theft and shoplifting or install an in-store security system.

3. Choose a right-sized deductible

If you choose a higher deductible for your commercial property policy, it’s quite likely that you will pay less for your premium. Compare the cost of different types of deductibles, such as flat-rate, percentage, or per occurrence and choose what works best for your small business needs.

4. Bundle more than one policy

With NEXT, you save 10% if you combine more than one type of insurance policy to create a secure business insurance package.

For example, if you add general liability insurance to your commercial property insurance, you can benefit from a discounted business owner’s policy (BOP) for more coverage at a cost savings.